Important Business Succession Planning language, by Colleen Watters Attorney at Law

In my experience, many business owners have not included language in their Business Succession Plan to address the needs of the business should the owner(s) become incapacitated or pass away.

If the business formation is a sole proprietorship and the owner utilizes Schedule C for tax purposes, simply listing the business on the Schedule A of their Trust can be sufficient. If the business is valuable, then a discussion regarding business entity formation is important, and assigning the business to the owner’s trust may be appropriate.

Planning techniques are likely to have transfer tax considerations that must be evaluated by an attorney and a CPA. Changes in tax laws, as well as the business owner’s estate value, may require ongoing reevaluation and potential adjustments to the plan by outside advisors.

As the “baby boom” ages, understanding a variety of approaches to planning for business exits and succession planning will grow in importance. Approaching these strategies as a process and integrating a team of legal, tax, accounting, insurance, and financial professionals may help tax and legal professionals address the multitude of situations their clients may face.

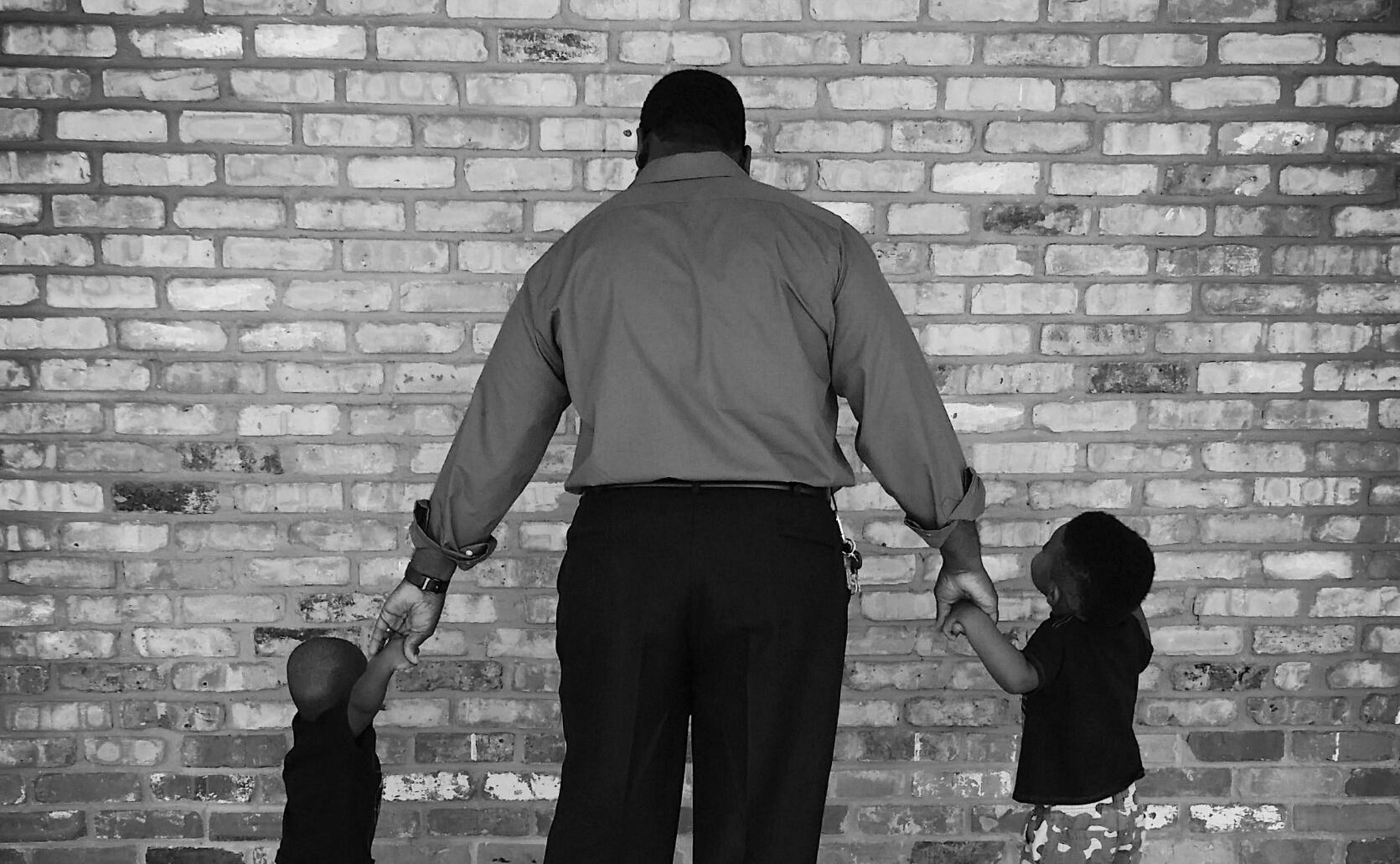

When a business owner wants to pass his or her business on to children, they should be certain the children want to continue to operate the business before gifting it to them.

How children relate must be considered as well. If children cannot work amicably, a busniess may not be the proper forum to attempt to force them to work together. Family behaviors and personalities can be an important part of this decision that organizational psychologists and other management professionals specialze in consulting on business family dynamics and succession planning.

Whether the next generation wants to be involved in the business and whether they will treat the business as a “sandbox” to play in or a “golden goose” to be nurtured and valued must be considered before the decision to pass on a busniess is made.

This article was contributed by Colleen Watters, Attorney At Law, a dedicated estate planning and probate lawyer.. She can be reached at:

916.225.3570

Read More

The Devil May Be in the Details

When the sale of a business falls apart, everyone involved in the transaction is disappointed – usually. Sometimes the reasons are insurmountable, and other times they are minuscule – even personal. Some intermediaries report a closure rate of 80 percent; others say it is even lower. Still other intermediaries claim to close 80 percent or higher. When asked how, this last group responded that they require a three-year exclusive engagement period to sell the company. The theory is that the longer an intermediary has to work on selling the company, the better the chance they will sell it. No one can argue with this theory. However, most sellers would find this unacceptable.

In many cases, prior to placing anything in a written document, the parties have to agree on price and some basic terms. However, once these important issues are agreed upon, the devil may be in the details. For example, the Reps and Warranties may kill the deal. Other areas such as employment contracts, non-compete agreements and the ensuing penalties for breach of any of these can quash the deal. Personality conflicts between the outside advisers, especially during the

due diligence process, can also prevent the deal from closing.

One expert in the deal-making (and closing) process has suggested that some of the following items can kill the deal even before it gets to the Letter of Intent stage:

- Buyers who lose patience and give up the acquisition search prematurely, maybe under a year’s time period.

- Buyers who are not highly focused on their target companies and who have not thought through the real reasons for doing a deal.

- Buyers who are not willing to “pay up” for a near perfect fit, failing to realize that such circumstances justify a premium price.

- Buyers who are not well financed or capable of accessing the necessary equity and debt to do the deal.

- Inexperienced buyers who are unwilling to lean heavily on their experienced advisers for proper advice.

- Sellers who have unrealistic expectations for the sale price.

- Sellers who have second thoughts about selling, commonly known as seller’s remorse and most frequently found in family businesses.

- Sellers who insist on all cash at closing and/or who are inflexible with other terms of the deal including stringent reps and warranties.

- Sellers who fail to give their professional intermediaries their undivided attention and cooperation.

- Sellers who allow their company’s performance in sales and earnings to deteriorate during the selling process.

Deals obviously fall apart for many other reasons. The reasons above cover just a few of the concerns that can often be prevented or dealt with prior to any documents being signed.

If the deal doesn’t look like it is going to work – it probably isn’t. It may be time to move on.

© Copyright 2015 Business Brokerage Press, Inc.

Photo Credit: jppi via morgueFile

Read MoreWhat a Study of 14,000 Businesses Reveals About How You Should “Not” Be Spending Your Time

In an analysis of more than 14,000 businesses, a new study finds the most valuable companies take a contrarian approach to the boss doing the selling.

Who does the selling in your business? Many business owners are personally involved in doing the selling. Is your business is a whole lot more profitable when you do the selling vs. the months when you leave the selling to others?

If so… that makes sense because you’re likely the most passionate advocate for your business. You have the most industry knowledge and the widest network of industry connections.

If your goal is to maximize your company’s profit at all costs, you may have come to the conclusion that you should spend most of your time out of the office selling, and leave the dirty work of operating your businesses to your underlings.

However, if your goal is to build a valuable company—one you can sell down the road—you can’t be your company’s number one salesperson. In fact, the less you know your customers personally, the more valuable your business.

The Proof: A Study of 14,000 Businesses

We’ve just finished analyzed our pool of Sellability Score users for the quarter ending December 31. 14,000 business owners were asked if they had received an offer to buy their business in the last 12 months, and if so, what multiple of their pre-tax profit the offer represented. We then compared the offer made to the following question:

Which of the following best describes your personal relationship with your company’s customers?

- I know each of my customers by first name and they expect that I personally get involved when they buy from my company.

- I know most of my customers by first name and they usually want to deal with me rather than one of my employees.

- I know some of my customers by first name and a few of them prefer to deal with me rather than one of my employees.

- I don’t know my customers personally and rarely get involved in serving an individual customer.

2.93 vs. 4.49 Times

The average offer received among all of the businesses we analyzed was 3.7 times pre-tax profit. However, when we isolated just those businesses where the owner does “not” know his/her customers personally and rarely gets involved in serving an individual customer, the offer multiple went up to 4.49.

Companies where the founder knows each of his/her customers by first name get discounted, earning offers of just 2.93 times pre-tax profit.

Example with $500,000 annual pre-tax profit:

Multiple Offer

Owner knows each of his/her customers by name 2.93 $1,465,000

Survey average 3.70 $1,850,000

Owner does “not” know his/her customers by name 4.49 $2,245,000

When Value Is the Enemy of Profit

Who you get to do the selling in your company is just one of many examples where the actions you take to build a valuable company are different than what you do to maximize your profit. If all you wanted was a fat bottom line, you likely wouldn’t invest in upgrading your website or spend much time thinking about the squishy business of company culture.

How much money you make each year is important, but how you earn that profit will have a greater impact on the value of your company in the long run.

Want to learn about selling your business and what your own personal Sellability Score is? Click here.

If you’re interested in learning about your selling options, getting a professional business valuation, or getting help creating an exit strategy, please feel free to give Evolution Advisors a call at 916.993.5433 or visit our website: www.EvoBizSales.com

Read More

Family Businesses

A recent study revealed that only about 28 percent of family businesses have developed a succession plan. Here are a few tips for family-owned businesses to ponder when considering

selling the business:

- You may have to consider a lower price if maintaining jobs for family members is important.

- Make sure that your legal and accounting representatives have “deal” experience. Too many times, the outside advisers have been with the business since the beginning and just are not “deal” savvy.

- Keep in mind that family members who stay with the buyer(s) will most likely have to answer to new management, an outside board of directors and/or outside investors.

- All family members involved either as employees and/or investors in the business must be in agreement regarding the sale of the company. They must also be in agreement about price and terms of the sale.

- Confidentiality in the sale of a family business is a must.

- Meetings should be held off-site and selling documentation kept off-site, if possible.

- Family owners should appoint one member who can speak for everyone. If family members have to be involved in all decision-making, delays are often created, causing many deals to fall apart.

Many experts in family-owned businesses suggest that a professional intermediary be engaged by the family to handle the sale. Intermediaries are aware of the critical time element and can help sellers locate experienced outside advisers. They can also move the sales process along as quickly as possible and assist in negotiations.

Keeping it in the Family

It’s hard to transfer a family business to a younger kin. Below are some statistics regarding family businesses.

- 30% of family businesses pass to a second generation.

- 10% of family businesses reach a third generation.

- 40% to 60% of owners want to keep firms in their family.

- 28% of family businesses have developed a succession plan.

- 80% to 95% of all businesses are family owned.

Source: Ted Clark, Northeastern University Center for Family Business

© Copyright 2015 Business Brokerage Press, Inc.

Photo Credit: naomickellogg via morgueFile

Read More9 Warning Signs You’re a “Hub-and-Spoke” Owner and how to create a more valuable business

If you were to draw a picture that visually represents your role in your business, what would it look like? Are you at the top of a traditional Pyramid-like organizational chart, or are you stuck in the middle of your business, like a hub in a bicycle wheel?

As anyone who has tried to fly United when Chicago has been hit by a snowstorm knows, a hub-and-spoke model is only as strong as the hub. The moment the hub is overwhelmed, the entire system fails. Acquirers generally avoid hub-and-spoke managed businesses because they understand the dangers of buying a company too dependent on the owner. Here’s a list of nine warning signs you’re a hub-and-spoke owner and some suggestions for pulling yourself out of the middle of your business:

1. You sign all of the checks

Most business owners sign the checks, but what happens if you’re away for a couple of days and an important supplier needs to be paid? Consider giving an employee signing authority for checks up to an amount you’re comfortable with, and then change the mailing address on your bank statements so they are mailed to your home (not the office). That way, you can review all signed checks and make sure the privilege isn’t being abused.

2. Your mobile phone bill is over $200 a month

If your employees are out of their depth a lot, it will show up in your mobile phone bill because staff will be calling you to coach them through problems. Ask yourself if you’re hiring too many junior employees. Sometimes people with a couple of years of industry experience will be a lot more self-sufficient and only slightly more expensive than the greenhorns. Also consider getting a virtual assistant (VA), who can act as a first line of defense in protecting your time.

3. Your revenue is flat when compared to last year’s

Flat revenue from one year to the next can be a sign you are a hub in a hub-and-spoke model. Like forcing water through a hose, you have only so much capacity. No matter how efficient you are, every business dependent on its owner reaches capacity at some point. Consider narrowing your product and service line by eliminating technically complex offers that require your personal involvement, and instead focus on selling fewer things to more people.

4. Your vacations are not really vacations

If you spend your vacations dispatching orders from your mobile, it’s time to cut the tether. Start by taking one day off and seeing how your company does without you. Build systems for failure points. Work up to a point where you can take a few weeks off without affecting your business.

5. You spend more time negotiating than a union boss

If you find yourself constantly having to get involved in approving discount requests from your customers, you are a hub. Consider giving front-line, customer-facing employees a band within which they have your approval to negotiate. You may also want to tie salespeople’s performance bonuses to gross margin for sales they generate so you’re rewarding their contribution to profit, not just chasing skinny margin deals.

6. You close up every night

If you’re the only one who knows the close-up routine in your business (count the cash, lock the doors, set the alarm), then you are very much a hub. Write an employee manual of basic procedures (close-up routine, e-mail footer to use, voice mail protocol) for your business and give it to new employees on their first day on the job. This is a great way to start “systemizing” your business.

7. You know all of your customers by first name

It’s good to have the pulse of your market, but knowing every single customer by first name can be a sign that you’re relying too heavily on your personal relationships being the glue that holds your business together. Consider replacing yourself as a rainmaker by hiring a sales team or 2iC (2nd in Command), and as inefficient as it seems, have a trusted employee shadow you when you meet customers so over time your customers get used to dealing with someone else.

8. You get the tickets

Suppliers’ wooing you by sending you free tickets to sports events can be a sign that they see you as the key decision maker in your business for their offering. If you are the key contact for any of your suppliers, you will find yourself in the hub of your business when it comes time to negotiate terms. Consider appointing one of your trusted employees as the key contact for a major supplier and give that employee spending authority up to a limit you’re comfortable with.

9. You get cc’d on more than five e-mails a day

Employees, customers and suppliers constantly cc’ing you on e-mails can be a sign that they are looking for your tacit approval or that you have not made clear when you want to be involved in their work. Start by asking your employees to stop using the cc line in an e-mail; ask them to add you to the “to” line if you really must be made aware of something – and only if they need a specific action from you.

The “Hub-and-Spoke” philosophy is one of the 8 key attributes in The Sellability Score. Take our 15 minute survey to learn more about how your business’s Sellability Score and how to create more a valuable business. Click here.

If you’re interested in learning about your selling options, getting a professional business valuation, or getting help creating an exit strategy, please feel free to give Evolution Advisors a call at 916.993.5433 or visit our website: www.EvoBizSales.com

Read More

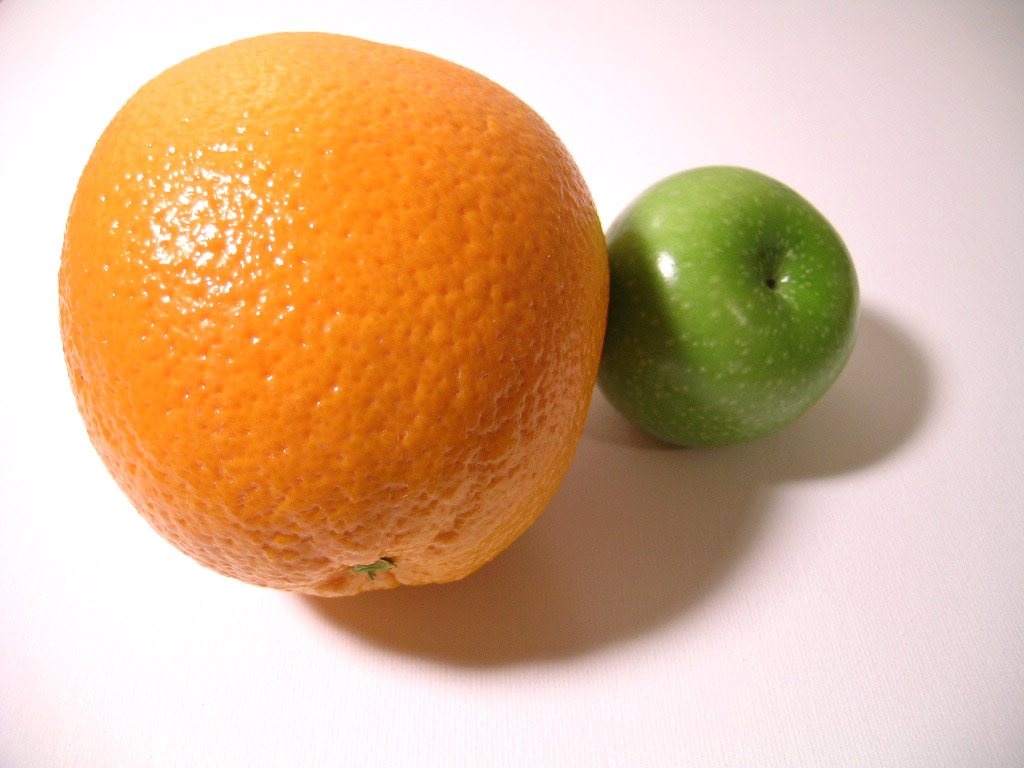

Two Similar Companies ~ Big Difference in Value

Consider two different companies in virtually the same industry. Both companies have an EBITDA of $6 million – but, they have very different valuations. One is valued at five times EBITDA, pricing it at $30 million. The other is valued at seven times EBITDA, making it $42 million. What’s the difference?

One can look at the usual checklist for the answer, such as:

- The Market

- Management/Employees

- Uniqueness/Proprietary

- Systems/Controls

- Revenue Size

- Profitability

- Regional/Global Distribution

- Capital Equipment Requirements

- Intangibles (brand/patents/etc.)

- Growth Rate

There is the key, at the very end of the checklist – the growth rate. This value driver is a major consideration when buyers are considering value. For example, the seven times EBITDA company has a growth rate of 50 percent, while the five times EBITDA company has a growth rate of only 12 percent. In order to arrive at the real growth story, some important questions need to be answered. For example:

- Are the company’s projections believable?

- Where is the growth coming from?

- What services/products are creating the growth?

- Where are the customers coming from to support the projected growth – and why?

- Are there long-term contracts in place?

- How reliable are the contracts/orders?

The difference in value usually lies somewhere in the company’s growth rate!

© Copyright 2015 Business Brokerage Press, Inc.

Photo Credit: jeltovski via morgueFile

Read MoreIs Now the Time To Sell Your Business?

Have you been thinking about selling your business but just can’t decide if now is the best time? Do you find yourself repeatedly analyzing the economic situation and wishing you had a crystal ball? There are positive signs and there are negative signs….

If you’re still up in the air and can’t quite decide whether or not to hit the eject button in deciding if it’s time to sell your business, here are six reasons you might want to consider getting out now.

- You’re less interested in fighting the good fight

A lot of business owners took the Great Recession in the teeth. If you’ve got your business stabilized and the prospect of possibly having to fight through another recession leaves you panic-stricken, it could be time for you to get out.

2. The worst is behind you

Let’s say you were mentally ready to consider selling a few years ago and then 2008 hit and 2009 was bad, and in 2010 and 2011 you made cuts and adjustments, so now you’re starting to see some profit and revenue growth. With your numbers going in the right direction, now might be just the right time to make your move.

- The tax man is coming

Governments around the world are looking for money to fund the cost of an aging population. At some point this will mean increased taxes.

- Nobody is lucky forever

If you’re lucky enough to be in a business that actually benefits from a bad economy, congratulations… you’ve probably just had the four best years of your business life. But no cycle lasts forever and right now might be a great time to take some chips off the table.

- The coming glut

As a business owner, demographics are not on your side. As the baby boomers start to retire in droves, we’re going to have a glut of small businesses coming on the market. That’s great if you’re buying; but if you’re a seller, you may want to avoid the flood and head for higher ground now. I am sure you have heard… but 10,000 baby boomers are retiring each day and this will continue for the next 16 years.

- The closing window

Since 2008, it’s been tougher for private equity companies to raise money; so many firms had their last successful round of fundraising a number of years ago. Many of these funds have a five-year window in which to invest or they have to give the money back to the people who gave it to them. Some boutique private equity firms will make investments in companies that have at least one million dollars in pre-tax profits (larger private equity firms will not go below $3 million in EBITDA); so if you’re in the seven-figure club, you could get a bidding war going for your business among private equity buyers keen to invest their money before they have to give it back.

Want to learn what your own personal Sellability Score is? Click here.

If you’re interested in learning about your selling options, getting a professional business valuation, or getting help creating an exit strategy, please feel free to give Evolution Advisors a call at 916.993.5433 or visit our website: www.EvoBizSales.com

Read More

What Are Buyers Looking for in a Company?

It has often been said that valuing companies is an art, not a science. When a buyer considers the purchase of a company, three main things are almost always considered when arriving at an offering price.

Quality of the Earnings

Some accountants and intermediaries are very aggressive when adding back, for example, what might be considered one-time or non-recurring expenses. A non-recurring expense could be:

- meeting some new governmental guidelines,

- paying for a major lawsuit, or

- adding a new roof on the factory.

The argument is made that a non-recurring expense is a one-time drain on the “real” earnings of the company. Unfortunately, a non-recurring expense is almost an oxymoron. Almost every business has a non-recurring expense every year. By adding back these one-time expenses, the accountant or business appraiser is not allowing for the extraordinary expense (or expenses) that come up almost every year. These add-backs can inflate the earnings, resulting in a failure to reflect the real earning power of the business.

Sustainability of Earnings

The new owner is concerned that the business will sustain the earnings after the acquisition. In other words, the acquirer doesn’t want to buy the business if it is at the height of its earning power; or if the last few years of earnings have reflected a one-time contract, etc. Will the business continue to grow at the same rate it has in the past?

Verification of Information

Is the information provided by the selling company accurate, timely, and is all of it being made available? A buyer wants to make sure that there are no skeletons in the closet. How about potential litigation, environmental issues, product returns or uncollectible receivables? The above areas, if handled professionally and communicated accurately, can greatly assist in creating a favorable impression. In addition, they may also lead to a higher price and a quicker closing.

© Copyright 2015 Business Brokerage Press, Inc.

Photo Credit: mconnors via morgueFile

Read MoreWhat’s so special about “The EBITDA Million Dollar Mark”

If you’re wondering when is the right time to sell your business, you may want to wait until your company is generating $1 million in earnings before interest, taxes, depreciation, and amortization (EBITDA).

What’s so special about the million-dollar mark?

The EBITDA million dollar mark is a tipping point at which the number of buyers interested in acquiring your business goes up dramatically. The more interested buyers you have, the better multiple of earnings you will command.

Since businesses are often valued on a multiple of earnings, getting to a million in profits means you’re not only getting a higher multiple but also applying your multiple to a higher number.

For example, according to our research at www.SellabilityScore.com, a company with $200,000 in EBITDA might be lucky to fetch three times EBITDA, or $600,000. A company with a million dollars in EBITDA would likely command at least five times that figure, or $5 million. So the company with $1 million in EBITDA is five times bigger than the $200,000 company, but almost 10 times more valuable.

There are a number of reasons that offer multiples go up with company size but one of the main reasons has to do with Private Equity Groups (PEGs) as they make up a large chunk of the acquirers in the mid market. The value of your company will move up considerably if you’re able to get a few PEGs interested in buying your business. But most PEGs are looking for companies with at least $1 million in EBITDA. The million-dollar cut-off is somewhat arbitrary, but very common. As with homebuyers who narrow their house search to houses that fit within a price range, or colleges that look for a minimum SAT score, if you don’t fit the minimum criteria, you may not be considered.

If you’re close to a million dollars in EBITDA and getting antsy to sell, you may want to hold off until your profits eclipse the million-dollar threshold, because the universe of buyers—and the multiple those buyers are willing to offer—jumps nicely once you reach seven figures.

Want to learn what your Sellability Score is? Click here.

If you’re interested in learning about your selling options, getting a professional business valuation, or getting help creating an exit strategy, please feel free to give Evolution Advisors a call at 916.993.5433 or visit our website: www.EvoBizSales.com

Read More